Overview

Digital asset custodial solutions are third-party service providers, businesses, or individual investors that manage and safeguard digital assets on behalf of the asset owners. Custodians are responsible for protecting the integrity of digital assets and securing them from theft, unauthorized access, and cyberattacks.

The tokenized asset market is growing exponentially but since these assets exist in the digital landscape, they are vulnerable to cybercrimes and thefts. Furthermore, due to the anonymity and irreversibility of blockchain digital asset transactions, recovery of these stolen assets is difficult.

The decentralized economy is mostly unregulated and vulnerable to scams, money laundering, fraud, and other financial crimes. In asset tokenization, the issuance of digital tokens, trading, recording stakeholder information, or distribution of dividends is done digitally. Custodian solutions offer safekeeping services and prevent unauthorized entities from accessing and stealing sensitive information and funds.

Key Takeaways:

- Digital asset custodial solutions offer custodian wallet services that securely store private keys on behalf of the asset owners.

- Asset custody platforms help to diversify investments and offer greater returns.

- Digital custodians have accelerated the adoption and continuous growth of tokenized assets.

- As the digital asset industry continues to evolve, traditional financial institutions and prominent banks are ready to offer their custodian services creating a conducive environment for digital asset investors.

Who are Digital Asset Custodians?

The role of digital asset custodians is quite similar to traditional financial custodians but there are some key differences. Let us find out.

A traditional asset custodian is a financial institution like a bank, a trusted company, or a brokerage service that safeguards large amounts of assets for their clients. They can also facilitate transactions or are authorized to manage assets for incapacitated clients.

A digital asset custodian performs the same responsibilities, i.e., securing the digital assets but they operate differently. Tokenized assets like other digital assets are stored or transferred virtually using cryptography within blockchain networks. These digital documents are crucial as they are the only records available to confirm the existence of these digital assets.

The ownership of these tokenized or digital assets is represented by cryptographic keys. Unlike traditional custody services, tokenized asset custodians store and protect these cryptographic keys instead of physically storing the actual asset.

These keys are of two types, private and public keys that pair with each other to validate and execute a transaction.

Private keys

They are a string of numbers that validate the ownership rights of the digital asset. The owner uses these keys to digitally sign, verify, and execute transactions or transfer digital tokens. The digital asset custodian restricts unauthorized access and protects the private key. A private key works like a conventional PIN code of an ATM.

Pubic keys

These keys are available publicly and used to generate an address for transferring and depositing funds to the owner’s wallet. A public key pairs with a private key. The private key decrypts the information and completes the transaction. A public key can be compared to a conventional bank account number which the owner shares publicly to receive and transfer funds.

Traditional Financial (TradeFi) Custodians Vs. Digital Financial (DeFi) Custodians

Both TradeFi custodians and digital asset custodians operate on some fundamental principles:

- They both operate to safeguard and store assets on behalf of the respective clients or asset owners

- Both facilitate cross-border or international transactions

- They protect client’s assets from being stolen, scams, and other fraudulent activities.

Despite the similarities, digital asset custodians offer certain benefits, especially within the virtual landscape that make them more popular or preferred option than traditional financial asset custodians.

- Digital asset custodians operate on blockchain’s decentralized framework. This allows them to automate the asset handling aspects allowing businesses to focus on strategic development and core functionalities.

- Traditional financial custodians are regulated by intermediaries. They operate through multiple layers of manual processes that can be costly, time-consuming, and hinder operational efficiency.

- Digital asset custodians are open 24/7 and 365 days, whereas traditional custodians like banks have fixed working hours.

- Digital custodian wallets are protected by multiple layers of security to protect the assets from scams and potential cyber threats.

- Digital custodian solutions offer real-time asset visibility and increase transparency and trust among asset owners. Traditional custodians have limited transparency.

- Digital custodians have pivoted the involvement and adoption of traditional financial institutions in the digital realm.

Importance of Custody Solutions for Tokenized Assets

The institutional adoption of digital assets has accelerated and has propelled businesses to realize the paramount importance of a secure custody solution. The market value of digital asset custody solutions has grown over the years and touched $447897.65 million in the year 2022. It is estimated to grow at a CAGR of 23.65% and reach a value of $3742821.31 million by 2032.

Custodian services seek to empower its clients with seamless management of their tokenized assets and assist in navigating the complex regulatory scrutiny and compliance measures.

Blockchain technology is an integral part of tokenized asset custody solutions. Digital asset custody services leverage blockchain’s distributed ledger technology and offer the following benefits to businesses:

- Immutable and transparent recordkeeping of custody transactions

- Advanced cryptographic security measures protect funds and transactions from infiltrations and hacking attempts

- Easy and accurate settlement of asset transactions eliminating manual errors

- Self-executing smart contracts automate timely custody transactions and regulatory compliance

Traditional custodial services are vulnerable to cyber threats and hacks. Digital asset custody services reduce these risks and secure the assets online.

Digitalization, secure online storage, and regulatory compliance streamline hassle-free custody transactions and attract more investors to explore the market.

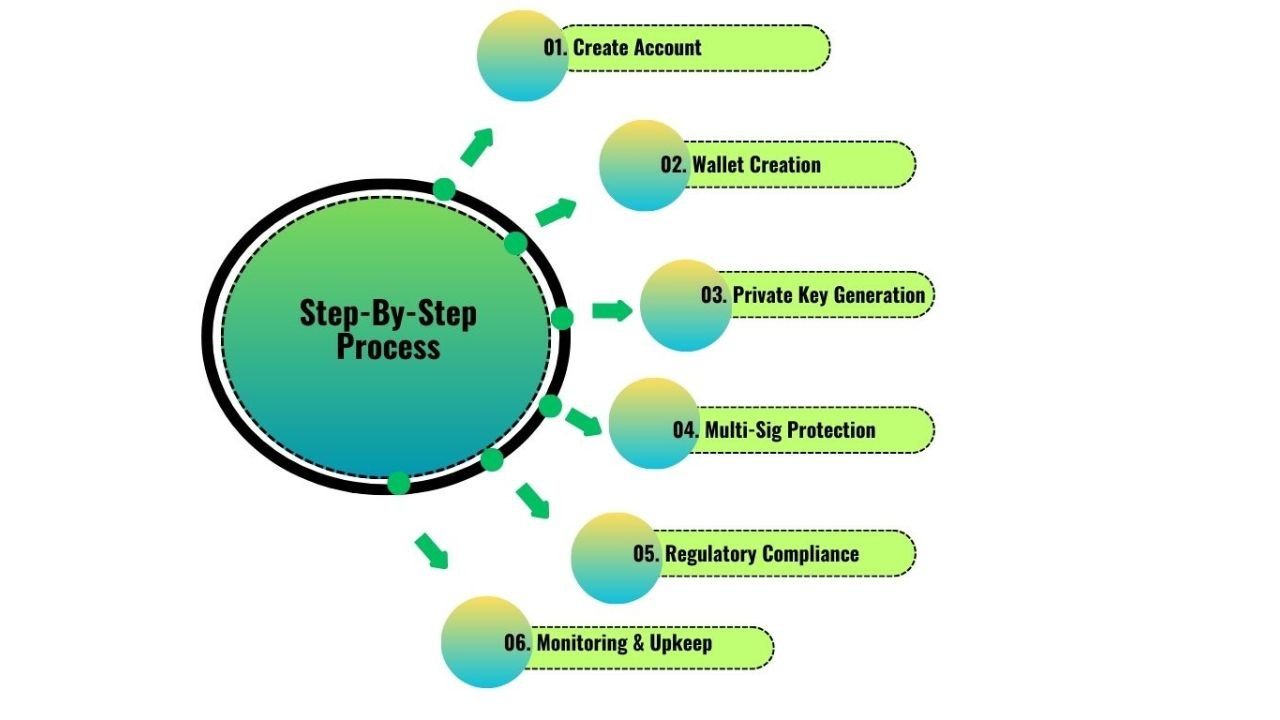

How Does Digital Asset Custodian Services Work – Step-By-Step Process

The main objective of a digital asset custody service provider is the safekeeping of private keys.

Step 1 – Setting up the account

Before setting up the account, companies or individuals must undergo a verification process and regulatory requirements. After proper verification, the account is set up in the custodian platform.

Step 2 – Wallet creation

After the client has successfully set up the account, the custodian creates a hot or software (online) wallet or a cold wallet (offline).

Step 3 – Generating private keys

Private keys for each wallet are generated. The custodian protects and manages these private keys.

Step 4 – Multi-signature protection

Multi-sig protection needs all the private keys to authorize and execute transactions. This adds additional layers of protection and eliminates risks of fraud, theft, or cyber threats. A transaction is executed once all the parties involved approve the transaction.

Step 5 – Regulatory compliance

Regulatory compliance is an important part of digital asset custodian services. Custodians must diligently document the regulatory reports and adhere to financial regulations.

Step 6 – Monitoring and Upkeep

Custodians monitor the asset status, transactions, regulatory compliance, and safety 24/7, and keep the clients informed.

What are the Different Types of Digital Asset Custody Solutions?

Digital asset custody solutions are of different types catering to the unique needs of the investors.

Self-custody

Self-custodians protect and manage the assets on their own without hiring an outside custody service provider. Many companies and investors prefer to supervise and store their private keys without relying on a custody service provider. This gives them greater authority over their assets and wallets and eliminates custody service fees.

Self-custodians are entirely in charge of protecting their private keys and funds. They must follow and implement the best practices for securely storing private keys and other passwords.

Exchange wallets

Exchange platforms host wallets to manage and safekeeping clients’ private and public keys. They manage these keys on behalf of their clients. They use a combination of cold (offline) storage and hot (online) storage, two-factor (2FA), multi-signature authentication, and other layers of security to protect the funds. Clients get access to their funds through their wallets.

Exchange platforms are convenient for crypto beginners or high-frequency tokenized asset traders but are also susceptible to counterparty risks such as theft of assets or misuse of private information.

Third-party custodians

Third-party custodians are professional custody service providers for digital assets. They can be licensed, and protect and manage assets for clients. They manage the private keys but operate as an agent and do not hold the client’s assets.

These custodians are regulated and audited, providing a secure environment and infrastructure for managing client assets. They follow high standards and implement proper regulatory guidelines and policies for custodian services.

Financial institutions

Traditional financial institutions like certain banks and reputed financial firms have expanded their custodian services to protect and manage digital assets. Earlier these traditional custodian solutions like banks restricted their services to a limited number of traditional assets. The involvement of conventional financial institutions will offer better regulatory clarity and encourage more investments in tokenized assets.

Digital Asset Custody Benefits and Challenges

Digital asset custody solutions are still nascent, and have their share of benefits and challenges.

Benefits:

- Provides enhanced security features, active insurance, and a secure environment to mitigate risks.

- Simple to use as the custodian service providers monitor, manage, and store the private keys for the asset owners.

- Fosters operational efficiency as everything is automated through smart contracts lowering risks of human errors.

- Digital asset custodians help to diversify asset portfolios, enhance investments, and spread and mitigate risks.

- Offers multiple layers of security and greater protection to eliminate misuse, unauthorized access, and hacks.

- Digital asset custodian service providers are often licensed, offering compliance measures and regulatory standards for digital assets.

Challenges:

Security lags

Cold wallets are often considered safer than hot wallets as all the private keys are stored offline. They can maximize security but slow down asset transfer and transaction execution processes, especially for high-speed transactions. Using hot wallets or online wallets can provide speed but are susceptible to online threats and security breaches.

Higher costs and operational inefficiency

Custodian services often offer value-added services like multi-sig facilities which can increase the overall costs.

The Bottom Line

In the rapidly evolving landscape of tokenized assets, the role of digital asset custodial solutions becomes crucial. Custodial services secure the ownership and trading of tokenized assets. Licensed custodians offer a solid regulatory platform for digital financial services fostering confidence and trust among investors. As the tokenized asset market continues to grow, many traditional financial institutions and large banks are coming forward to offer custodian services to support and accelerate the growing demand for digital assets. This will further boost digital asset investments in the future.