Overview

Commodities trading is a well-capitalized market and has been booming. Amidst the intense price volatility, the market has witnessed buoyant growth surpassing an all-time high of $100 billion in gross margin in 2022. Experts predict that the commodities market could reach $839.40 billion by 2024.

That said, the commodities market has always been demand-driven with slow supply movements and higher prices. These rigidities may cause inflation risks and pose challenges for low-income investors and smaller importers.

Now, imagine a market where you can easily access these highly illiquid commodities assets with nominal investments and get returns equivalent to high-net-worth or institutional investors. Tokenization is a blockchain-based innovation that could reshape the way we invest or trade in commodities.

Key takeaways:

- The commodities market is experiencing a price boom but remains significantly untapped due to its high prices, low supply, and inaccessibility

- Despite the market uncertainties, commodities trading has sustained an upward trajectory projected to generate $929.20 billion by 2029

- Commodities are considered as fungible assets that can be freely traded in commodity marketplaces

- Commodities tokenization is breaking the barriers and offering a transparent and viable solution to commodities trading

What are Commodities?

Commodities are tangible assets. They are natural or raw resources grown on the land, extracted, or mined. They are produced and traded in large quantities for businesses’ manufacturing purposes or widespread consumption. Examples are crops, oil, metals, etc.

Commodities are categorized as fungible assets as they are easily and freely traded and exchanged with other identical assets of uniform quality in commodity markets.

What are the Different Types of Commodities Assets?

Commodities assets are divided into two main types:

Soft commodities

They are usually agricultural produce or livestock like cattle, goats, horses, pigs, etc., grown for toiling or food. Soft commodities are more volatile as their production depends on external factors like climatic changes, crop cycles, natural disasters that can lead to spoilage, etc. These factors can impact the prices of these commodities.

Hard commodities

These commodities are non-agricultural natural resources like crude oil, coal, gold, aluminum, or metal ores extracted or mined from the earth. They have a fixed source and their supply and demand are more consistent than soft commodities. Their prices show the economic prosperity, upswing, or downswing of a country. However, the prices of hard commodities are largely influenced by geopolitical tensions, government policies, technological developments, liquidity, or supply disruptions that can impact the prices.

Types of Commodities Assets that can be Tokenized

Agricultural commodities

These commodities include crops like coffee, rice, corn, and sugar that are produced for human consumption as well as are food for livestock.

Metals

Metals such as iron, copper, aluminum, lead, nickel, zinc, etc., are extracted and used in industries and for other commercial purposes.

Precious metals

Precious metals like platinum, gold, rhodium, or silver provide secure investments. These metals are extracted, refined, and categorized into different classes before they are traded based on their quality.

Commodities like gold are stored in bullion banks. The prices depend on the market conditions. Gold traders, central banks, manufacturers, and goldsmiths can buy gold from the bullion banks.

Silver is similarly extracted and traded as gold. But since they are found in copious amounts, they have less market value than gold.

Energy commodities

Energy commodities like oil, gasoline, crude oil, or natural gas are drilled from the earth and are capital-intensive. Factors like the supply, demand, and prices of these commodities can impact the global market and influence the transportation sector, government budgets, and even the stock market.

Commodity-backed crypto assets

A stablecoin is a commodity-backed crypto asset. Its value is tied to a commodity like diamond, gold, or oil. Unlike bitcoins, commodity-backed stablecoins provide stability against market volatility and price unpredictability. According to “CFTC” or Commodities Futures Trading Commission, stablecoins that are backed by fiat currencies should also be considered commodities.

Carbon credits

Carbon credits are green initiatives or rewards earned for trading carbon offsets. It focuses on environmental sustainability and encourages enterprises and individuals to minimize their carbon footprints in the environment.

Real estate

Real estate, land, houses, buildings, and other properties are commodities that can be easily tokenized and converted into digital assets.

Art and collectibles

Art and collectibles embody paintings, sculptures, visual art, and rare collectibles like fine art, coins, stamps, etc. They can be highly valued because of their popularity and rarity.

Commodities Tokenization – A Digital Shift to Commodities Trading

Tokenizing commodities breaks them into smaller bits or pieces represented as digital tokens. All this is possible with the use of blockchain technology. Each digital token signifies the fractional ownership of the commodity. These tokens are securely stored in the blockchain’s digital ledgers. When investors buy tokens, they earn ownership rights equivalent to their proportional shares in the underlying real-world asset.

Real-world asset or RWA tokenization opens new opportunities for stakeholders. Asset owners and traders can purchase or sell high-valued or rare assets previously inaccessible with nominal investments. For instance, a gold bar that is worth thousands of dollars can be split into 1000 tokens of smaller units that are affordable and can be easily purchased by investors. The best part of RWA tokenization is that the asset owner does not have to physically move the gold bar from the vault. Investors, on the other hand, can purchase the tokens using digital wallets from the comfort of their homes. It is a win-win situation for asset owners, asset managers, and investors where everything is done digitally through the implementation of blockchain and smart contracts.

Unlike cryptocurrencies, tokenized commodities’ value depends on the market condition, demand and supply, and prices of the underlying RWAs in the traditional market. This provides an added layer of stability and security to investors. Tokenized commodities have a predictable investment portfolio that provides price stability and boosts the confidence of traditional investors who are wary of investing in volatile crypto assets.

Tokenization dismantles the conventional barriers of high capital investments, market inaccessibility, low liquidity, etc., and democratizes commodities trading for a wide range of investors.

How to Tokenize Commodities?

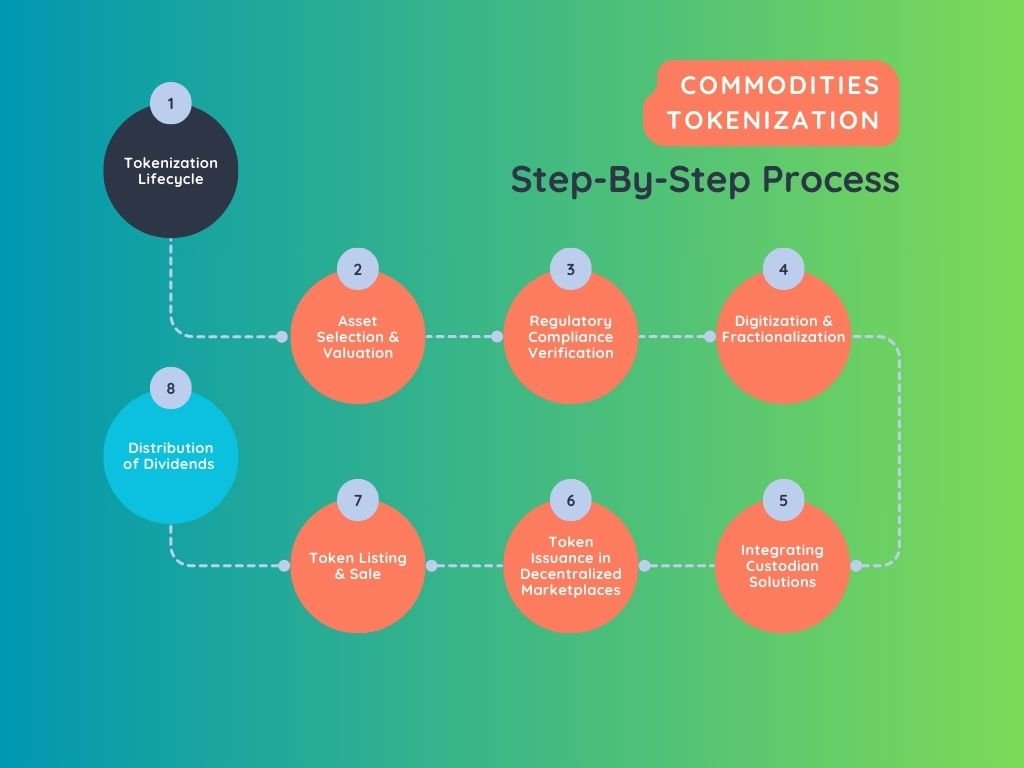

Tokenization involves the process of transforming commodities assets into tradable digital tokens. Here are the steps to tokenize a commodity asset:

Asset valuation

Asset owners must carefully select and evaluate the value of the commodity that they want to tokenize. The valuation depends on market factors, supply and demand, quality, profitability, and its ability to be tokenized.

Verification

After asset valuation, its ownership rights and regulatory requirements should be verified properly to avoid ownership disputes post-tokenization.

Tokenization

This involves the digitization process where assets are converted into tokens that represent the proportional fractional ownership rights of the original asset.

Custodians

Custodian services manage and safeguard tokenized assets. These custodian solutions prevent unsolicited access and protect valuable assets from thefts and cyberattacks.

Digital marketplaces

Tokens are issued and traded in decentralized commodity exchanges that are safe and reliable for trading. Secondary markets offer instant liquidity and easy exits for traders to quickly trade and liquidate their assets.

Token listing and sale

Once the decentralized marketplace is confirmed, tokens are listed for trading. Token trading is based on real-time market prices, supply, and demand. Once sold, all transactions are neatly and securely recorded on-chain.

Ownership settlements

After tokenization is complete, the fractional ownership rights of the tokenized commodity are transferred from the asset owner to the investors. Smart contracts distribute the tokens among stakeholders and share ownership rights.

What are the Benefits of Commodities Tokenization?

Tokenization can make a significant difference in commodities trading opening access to global markets for small-scale farmers and traders. Here are a few tokenization benefits:

Fractional ownership

The commodities market for oil or precious metals like gold or platinum are highly priced and regulated. Traditional commodity trading is not only expensive but cumbersome for average investors. Tokenization divides these high-value commodities into smaller shares or fractions that are affordable and can be easily traded in decentralized marketplaces. The fractionalization of assets diversifies the risks and makes it profitable for investors to trade even with low capital.

Democratizes access

Commodities tokenization breaks the conventional barriers of high investments and limited liquidity and enables everyone to trade in a regulated and otherwise inaccessible market. This expands the pool of investors and generates liquidity in the market.

Enhances liquidity

Commodity trading is a slow-moving industry hugely dominated by institutional and wealthy investors. Real-world asset tokenization brings agility into the market and broadens the scope of trading. Decentralized marketplaces are not time-constricted and operate 24/7 where traders can securely trade their holdings at any time of the day. Furthermore, secondary markets provide alternative trading opportunities, and quick and instant settlements for traders. All these factors contribute to the overall liquidity of the market.

Market stability

Tokenized commodities are tied to traditional real-world assets and provide market stability, unlike other digital assets like cryptocurrencies. Tokenized assets are less volatile in nature. This generates market trust and boosts the confidence of the investors.

Enhances efficiency and traceability

Tokenization with the help of blockchain enables traders to track supply chains, audit the transactions, and keep accurate records. Traditional commodity trading is complicated, has a lengthy process, and is expensive. Smart contracts streamline the process of trading and distribution of dividends and asset ownership among stakeholders, reducing manual errors, and bureaucratic interferences.

Looking Forward – The Future of Commodities Tokenization

The future of commodities tokenization seems bright. It is a transformative step that empowers investors by democratizing entry to the lucrative market of traditional commodities. The market become more inclusive, agile, and flexible drawing in significant liquidity and new investment opportunities for average investors. As the tokenized commodities market evolves, it is time to establish much-needed regulatory standards and advanced innovative applications for wider adoption.