Overview

The allure of real estate investments, the steady and high returns, ownership rights, and promises of a secure financial future have drawn investors for generations. However, historically, the conventional real estate industry was mired by barriers like low liquidity, bureaucracy, high capital commitments, complex legal proceedings, and lengthy property settlements. These are some factors why the market remains largely untapped, explored only by institutional investors and high-net-worth people.

But what if we tell you that it is possible to venture and invest in this highly lucrative asset class with modest investments? Yes, you heard it right!

Introducing real-estate asset tokenization – a novel and innovative technology revolutionizing real-estate asset investments and making them inclusive and affordable through fractional ownership.

Key Takeaways:

- Real-estate tokenization is a futuristic blockchain-based technology that makes property investments accessible for all that was previously shut for smaller investors

- Fractional ownership divides real estate into smaller shares that are co-owned by multiple investors

- Both real-estate investments and real-estate investment trusts (REITs) provide opportunities for investments through shares, but REIT investors do not gain any ownership rights

- Real-estate tokenization provides direct ownership and fund control to investors

What is the Tokenization of Real Estate?

The highly-priced, illiquid, and indivisible nature of the traditional real estate industry often poses significant challenges for small-scale investors. They had to pool all their resources and hard-earned money to invest in these assets.

Tokenization opens a world of new possibilities and encourages a broader base of investors from diverse economic backgrounds to participate in property investments.

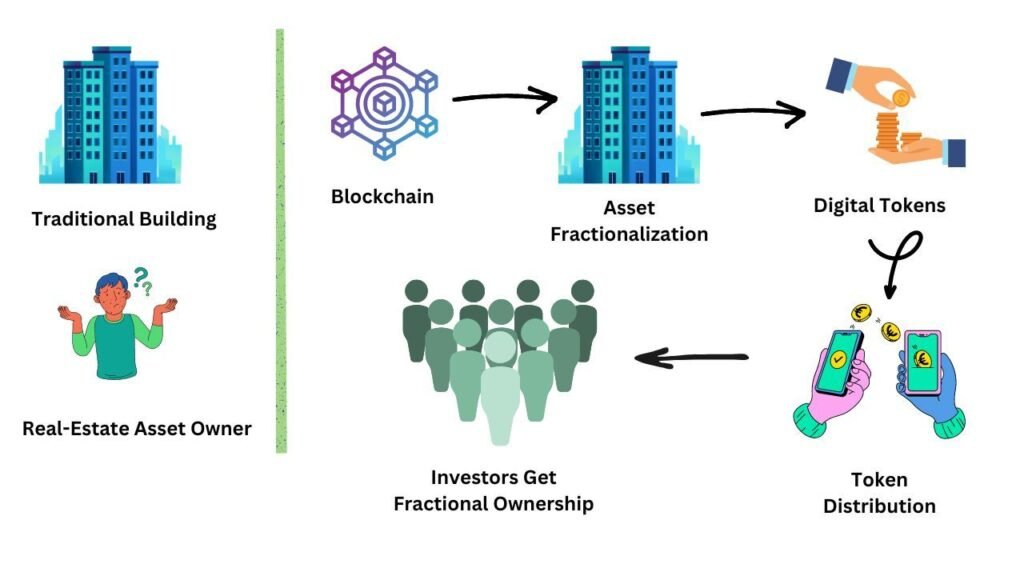

The magic behind real-estate tokenization is blockchain technology and the smart contract. Blockchain technology fragments a real-estate asset such as land, a residential area, or a commercial building into numerous smaller shares. These shares are represented as digital tokens and securely stored in the blockchain’s distributed ledger. Smart contracts automatize the tokenization process making it easier to transfer ownership and funds among counterparties.

Today, the real estate tokenization (RET) market is anticipated to expand from $3.8B to $26B within the next 10 years (2024-2034) at a CAGR growth rate of 2.90%. It is an incredible growth and a paradigm shift in property investments.

Real-world asset or RWA tokenization is no longer a niche market but has gained significant momentum over the years and has garnered the interest of mainstream investors as well as traditional financial institutions. Tokenization has the potential to transform a slow-moving industry like real estate into a more vibrant, inclusive, and affordable investment landscape.

Role of Fractional Ownership in Real Estate Tokenization

To further illustrate the concept of real-estate tokenization, we must first understand what fractional ownership is and the role it plays in tokenization.

Let’s say, you want to purchase a residential house in your locality. In the traditional market scenario, this purchase can occur in two ways – you may have to make a high upfront payment of the full price of the house or take a loan from the bank. Either way, arranging the money is expensive and unwieldy, especially for modest investors.

Fractionalization in real estate tokenization introduces a whole new concept where the asset is split into smaller, equal shares or parts represented as digital tokens in the blockchain ledger.

Imagine purchasing a 200,000 sq. ft. of building. Now, fractionalization in tokenization can break this asset into 100 equal fractions. Each fraction may denote 1000 sq. ft. and cost an investor, $2000 which is affordable compared to paying the entire amount. Investors can purchase as many shares as they want based on their capital threshold. From the asset owner’s perspective, divisibility makes the assets more accessible and it is easier to sell the property to multiple investors instead of finding an individual wealthy investor.

These digital tokens represent the shared ownership of the asset co-owned by the investors. Token holders are the fractional owners of the property. They gain voting rights, earn profit shares, and are also liable for losses incurred and tax implications.

Since everything is done digitally on decentralized platforms, anyone can participate and invest in tokenization.

Advantages of Fractional Ownership in Tokenization

Fractional ownership improves the saleability of the real-estate asset and exposes it to a wide network of potential investors. It improves market participation, fosters inclusivity, and empowers small-scale and retail investors to invest in the market.

Enhances investment opportunities

Fractional ownership gives access to a broader market which was inaccessible earlier due to high prices.

Flexibility in budget

Fractionalization does not require high capital investments. This allows investors to invest in assets depending on their preferences and financial strength. They can purchase a piece of their desired asset without paying the entire price.

Diversification of asset investments

Investors can invest in diverse asset classes. This reduces the impact of losses incurred in a poorly performing asset class. Diversification of investments also increases the overall investment returns.

Reduces financial risks

Investors only own a part of the asset. So, if there is a depreciation in the asset’s value or there is a loss, investors only incur partial losses.

Fractional Ownership in Real-Estate Tokenization (RET) Vs. R.E.I.Ts

Real Estate Investment Trusts, known as REITs are firms that manage and own high-income-yielding real estate. They handle a wide range of properties like apartments, hotels, retail centers, etc., and allow investors to earn income without physically buying them.

REITs are similar to traditional mutual fund investments. These firms pool the funds from a wide network of investors. In return, the investors earn income based on their investment shares.

Both REITs and RETs allow investors to pool their capital and invest in real estate, but there are some stark differences.

Key differences:

Asset ownership

REIT shareholders do not get ownership rights or direct control of the assets. They own trust shares, rather than owning a share of the actual property.

Real-estate tokenization grants actual ownership rights to the investors depending on their investment shares. RET investors can control their funds and get access to real-time data.

Type of property

REITs must invest at least 80% in fully complete income-generating commercial properties, and the remaining 20% can be on properties that are under construction.

In RET fractional ownership, there is no definitive rule. All kinds of assets including under-construction real estate can be tokenized.

Capital requirements

REIT investments require significant upfront capital and may attract only accredited investors.

Fractionalization in real-estate tokenization encourages more diversified, flexible, and smaller investments. This allows a broader participation of investors from diverse economic backgrounds.

Investment returns

Historically, REITs are known to offer more stable returns through dividends and rental income. However, the investment threshold in REITs is comparatively higher than real-estate tokenization and restricted to wealthy investors.

Real estate tokenization, on the other hand, offers a dynamic investment portfolio. It allows diversification of investments without the need for substantial capital. This amplifies the overall return on investments.

Investment risks

REIT share values are susceptible to economic uncertainty, market vulnerabilities, and changing interest rates.

Tokenized real estate can spread the risk profile by diversifying investments in multiple assets.

Liquidity profile

Traditional REITs are known for easy trading of shares and high liquidity but are influenced by trading restrictions and market changes.

Tokenizing real estate offers easy trading and almost instant liquidity in decentralized secondary markets. They offer greater flexibility and easy exits to investors.

Key participants

In REIT, the main players are the property managers, investors, and the trustee board.

In RET, the main participants are the investors, property owners, and the tokenization platform.

Top 6 Benefits of Tokenizing Real Estate

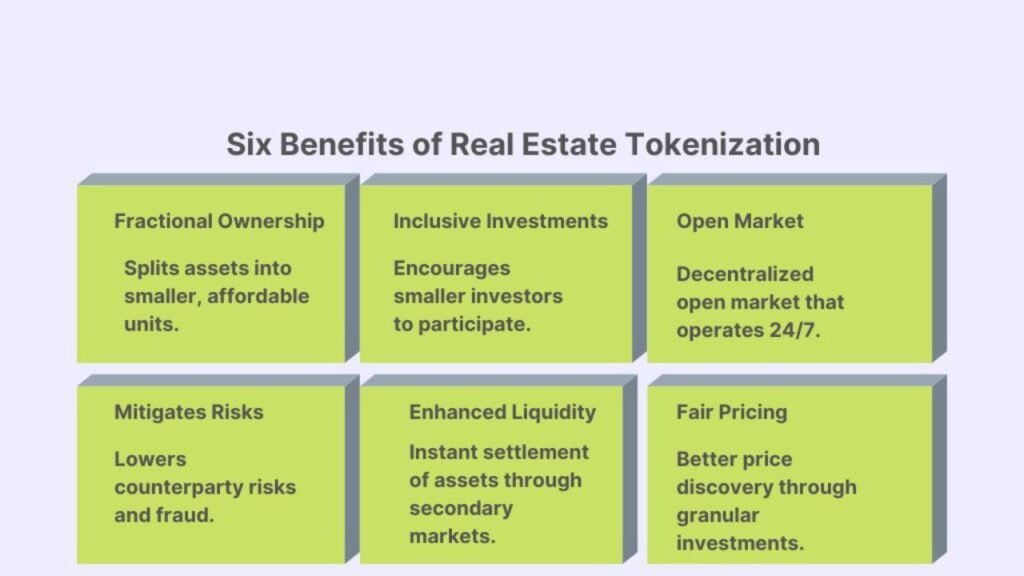

Fractional ownership

Tokenization provides direct ownership of the asset. Fractionalization divides the real estate asset into smaller affordable shares represented as digital tokens on blockchain ledgers. Co-investors own direct ownership based on their share of investments.

Encourages smaller investors

Tokenization makes investments inclusive and does not deter small-scale investors from investing in high-valued real estate assets. Fractionalization turns the assets into smaller shares that can be easily afforded by retail investors.

A free and open market

The real-world asset or RWA tokenization market is entirely decentralized and not overly regulated or scrutinized like traditional financial markets. This provides ample opportunities for investors to participate in tokenization anonymously and without traditional hindrances of intermediaries, bureaucracy, or lengthy settlements.

Lowers counterparty risks

The traditional real-estate market involves third parties like brokers, mediators, government authorities, etc., which makes the transactions complicated and lengthy. Blockchain and smart contracts automate and regulate transactions in real-time eliminating weak links, misinformation, fraud, and counterparty risks.

Improves liquidity

Fractionalization removes price and geographical barriers making real-estate investments accessible for everyone. As more asset owners and buyers participate in tokenization, it improves the overall liquidity of the market. Moreover, decentralized exchanges and secondary marketplaces offer better and instant liquidity to stakeholders.

Fair market-price discovery

The fractionalization of real estate provides better market insight and granular investments offer better price discovery. Asset owners can list their property in the market, get quotes from a different range of investors, and maximize their profits.

In Conclusion – The Future Beyond

Real-estate tokenization through fractional ownership makes it economical to invest in the property market. It democratizes investments making it inclusive for smaller investors to invest in properties of their choice without heavy capital requirements. Fractionalized ownership also benefits asset owners and high-net-worth investors to manage their investment portfolios and mitigate risks.

As the real estate market is booming, the future of real-estate tokenization seems bright unlocking new avenues in property investments.